“The COVID-19 pandemic has affected all industrial sectors, including infrastructure. To deal with such challenges, Waskita strengthened the synergy between the Company’s management and applied strategic policies by prioritizing the implementation of appropriate and consistent health protocols to strengthen the Company in line with Waskita’s commitment to continue to grow in a sustainable manner in order to realize the expectations of shareholders and stakeholders.”

Dear Valued Shareholders and Stakeholders,

Alhamdulillah, let us send our gratitude to the presence of Allah, Almighty God, since due to His grace, PT Waskita Karya (Persero) Tbk or Waskita or the Company can sail through the year of 2020 favorably, even in the midst of enormous social and economic challenges due to Pandemic Coronavirus Disease 19 (Covid-19). This is shown by the Company’s good operational and financial performance, among others, 27.59% increase in the number of project auctions won from the previous year. The Company’s competitiveness in terms of project value also increased by 3.92% when compared to the previous year.

All of these achievements were possible due to the hard work, not giving up attitude, and firm synergy between the Company’s elements in carrying out the mandate of managing the Company through a number of strategies and work programs to achieve Company’s vision, mission and goals of as well as Stakeholders’ expectations.

Through this Annual Report, please allow us to present the Company’s performance achievements throughout 2020, as a form of our accountability to Shareholders and all other stakeholders. This annual report is also an implementation of the Company’s transparency in upholding the principles of Governance in a consistent and continuous manner in carrying out daily business activities.

... Read MoreShow Less

2020 Macroeconomy

The spread of the Covid-19 has had an extraordinary impact on the global economy throughout 2020. This condition has caused the global economy in 2020 to face a crisis that has never been experienced before. The epicenter of this crisis is different from any previous crisis. The implementation of health policies to reduce the spread of Covid-19 has caused turmoil on financial markets and economic activities.

The Covid-19 and its handling policy through mobility restrictions triggered high global financial market uncertainty in the first half of 2020, which then put pressure on global financial markets and triggered more cautious investment behavior. The global economic slowdown resulted in a decline in world trade activities and commodity prices. The weakening of world demand due to the Covid-19 pandemic and disruption in global supply chain reduced the demand for the world exported and imported goods, resulting in decreased trade volume. In line with the progress in handling the Covid-19, increased mobility and continued policy stimulus, economic improvement began to be seen in a number of countries in the second semester of 2020. The process of global economic recovery continued in the fourth quarter of 2020.

Developments in various indicators in December 2020 confirmed the continuing improvement of global economy. However, overall global economic growth in 2020 is predicted to contract and recorded at -4.0%, down from 2.7% in 2019.

The Covid-19 pandemic put heavy pressure on Indonesia in 2020, not only on health and humanitarian aspects, but also on social and economic aspects. The slowdown in economy and the LargeScale Social Restriction (PSBB) policy to mitigate the spread of Covid-19, which reduced economic mobility, has resulted in a contraction in 2020 economic growth. The reduced mobility of people, goods and services has an impact on the weakening performance of almost all lines of business.

In the second semester, Indonesia’s economic growth began to improve in line with the easing of PSBB, the realization of increased fiscal stimulus, and the improvement in global economy. Increased mobility also supported the recovery of household consumption, particularly transportation, restaurant and hotel consumption. Spatially, the improvement in external and domestic demands also affected the economic recovery in several regions in Indonesia.

GDP contraction experienced a decrease in the third quarter, so that overall in 2020, Indonesia’s economic growth contracted by 2.07%. Inflationary pressure was also low in line with weak domestic demand. Meanwhile, the financial system, which was in good condition at the time the pandemic began, provided a cushion for the resilience of financial system. This condition was reflected in the remaining sound capital, credit quality and liquidity. However, the credit contracted by 2.4% in line with weak domestic demand and banking prudence in channeling credit.

The improving economy in the second semester of 2020 had a positive impact on the perception of investors, hence the foreign capital inflows were seen again and encouraged the strengthening of Rupiah exchange rate, as well as strengthened economic stability and accelerated the process of economic recovery.

... Read MoreShow Less

Quick Adaptation with Covid-19

The global COVID-19 pandemic has affected all industrial sectors, including the infrastructure sector. In the midst of the Government’s active efforts to accelerate infrastructure development, Covid-19 is a challenge that is quite difficult to overcome. The speed of infrastructure development must adjust to the conditions that force all parties to prioritize health and safety above all interests.

Slowly but surely, a new balance is formed when new habitual adaptation is declared as part of living a compromise with Covid-19. Infrastructure has become one of the sectors that has the flexibility to continue operating. Infrastructure development has also contributed positively to Indonesia’s gross domestic product (GDP) in the third quarter of 2020 by 10.6%, amidst a contraction of 4.31% (yoy).

This positive contribution is the success of adaptive phase upon the policies implemented by the government to overcome the challenges. Besides that, throughout 2020 the Government continued to encourage the completion of a number of national strategic projects (PSN) in order to provide overall benefits to the communities around the project area.

The Indonesian government continues to place infrastructure development as one of the priorities of the seven national development agendas in the National Medium Term Development Plan (RPJMN) 2020-2024 which aims to support economic activities and promote equitable distribution of national development. Every year, the budget for infrastructure development increases, recorded at Rp423.3 trillion, an increase of 5.90% from the previous year amounting to Rp399.7 trillion. The budget is used to build 486 kilometers of new road, 3 units of new airport, 49 units of dam, 19,014 meters of bridge, 238.8 kilometers of railways, 5348 units of MBR house, and 2000 units of special house.

On the other hand, accelerating infrastructure development is also an effort to catch up with Indonesia’s infrastructure competitiveness which is still at the level of 67.7 points from a scale of 0-100 based on the assessment of the 2019 Global Competitiveness Index (GCI) released by the World Economic Forum. This achievement made Indonesia ranked 72 out of 141 countries surveyed and 5th in the ASEAN region after Brunei Darussalam and Thailand. The first place is occupied by Singapore.

INFRASTRUCTURE BUDGET (TRILLION RUPIAH) Verification

PT Waskita Karya (Persro) Tbk as a business entity engaged in the infrastructure sector, fully supports the Government’s programs by actively participating and providing solutions in accelerating the national infrastructure development. The Company continues to work on infrastructure provision projects that can be a solution in driving the growth rate of various industrial sectors in Indonesia and accelerating connectivity

The Company is optimistic to be able to play a strategic role in contributing to increasing the national economic growth, by providing infrastructure needs that can reach the wider community. Moreover, infrastructure development is one of the important factors in accelerating the improvement of people’s welfare and poverty alleviation, opening up access to job opportunities, services, investment, and able to drive economic activity cycle, especially local economic activities. The Company is committed to continuing the infrastructure investment and development through strengthening strategies and synergies between elements of the Company.

... Read MoreShow Less

Analysis on Company Performance

Throughout 2020, the Company made every effort to realize the sustainable development goals and achieve the Company’s vision to become “A Trusted and Sustainable Indonesian Company in te Integrated Construction and Investment Sector”. The Company strives to increase the sustainable value of the Company by developing integrated systems and technology, building strong financial fundamentals, implementing excellent Enterprise Risk Management, forming competent and excellent performing human capital and achieving balanced portfolio through investment in new lines of business.

The Company has also established a new Corporate Culture Value, namely AKHLAK, an acronym for Trustworthy, Competent, Harmonious, Loyal, Adaptive and Collaborative. This change is in line with the directive from the Ministry of SOE. Pursuant to the Shareholders’ directive to review the Corporate Work Plan and Budget due to the challenges of the Covid-19 Pandemic, in mid2020, the Company revised the RKAP by making adjustments to financial and non-financial targets. This adjustment is one solution that is expected to enable Waskita to adapt with business changes and uncertainties.

Strategies, Strategic Policies and the Implementation

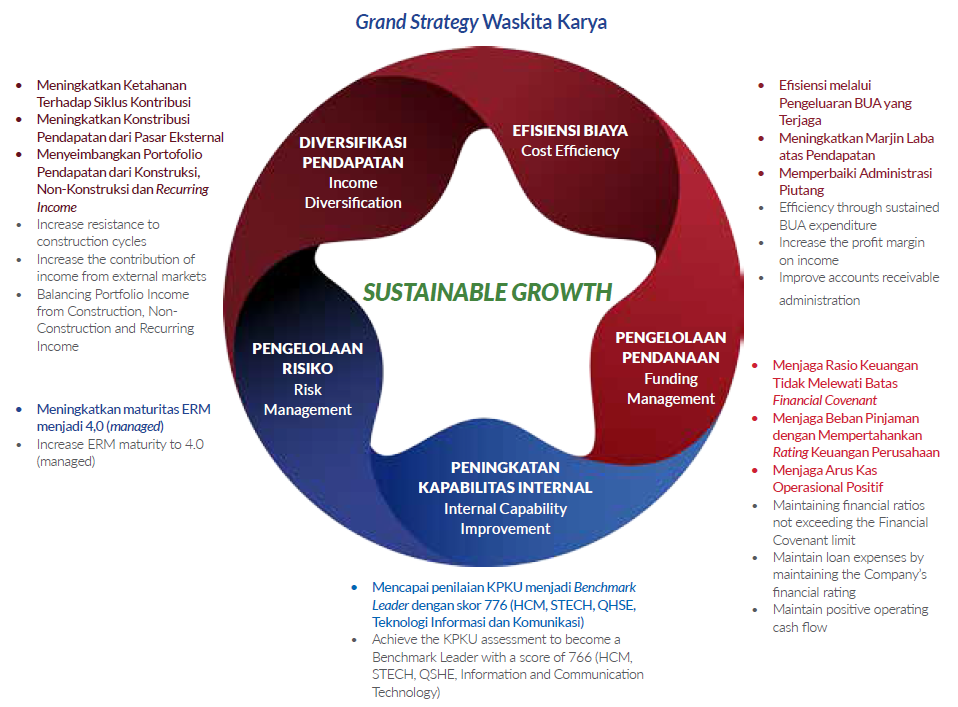

To achieve the vision, mission and targets of the Company, the Company has compiled a Grand Strategy which is set out in the Corporate Work Plan and Budget (RKAP) and the Corporate Long Term Plan (RJPP) 2020-2023 with the theme “Sustainability” or “Sustainability”.

Explanation:

- Income Diversification

The majority of Waskita’s income sources in the 2015-2019 period came from investments in subsidiaries, particularly in the toll road sector. However, this toll road investment is long-term with high short-term risks.

Therefore, in order to maintain sustainable growth going forward, Waskita needs to diversify its income by balancing its investment portfolio as well as penetrating external markets and managing recurring income. - Cost Efficiency

In order to anticipate all changes that occur with regard to internal and external environmental conditions, thus having the sustainable competitive advantage) and achieve an increase in conventional construction contracts, a strategy is needed to increase Waskita’s competency, namely by carrying out cost efficiency.

Cost efficiency can be done while maintaining operating profit margins, through cost efficiency in all Waskita segments and improvements in accounts receivable management as well as improving the quality and K3LM. - Funding Management

Waskita’s super growth phase that occurred in 2015-2019 was inseparable from the change made in Waskita’s business direction, in which not only act as a contractor, but also as an investor. Therefore, good funding management is needed to finance the investments to increase added value for Waskita.

In order to achieve sustainable growth for Waskita going forward, funding management through structured, accurate and controlled planning and implementation while still meeting the financial covenants required by banks, maintaining cost of funds and maintaining positive operational cash flow is needed. - Internal Capability Improvement

To achieve sustainable growth, must be supported by the Company’s internal scalability. This needs to be supported by improving the Company’s internal capabilities, including:- Cash flow management;

- Portfolio management;

- Risk management;

- Standardization of production;

- Optimization and integration of SAP system;

- Human capital development.

- Risk Management

Waskita’s rapid growth needs to be supported by measured and effective risk management through Enterprise Risk Management Framework (“ERM”) as the basis for Board of Directors’ decision making in order to increase effectiveness and efficiency in achieving Company’s goals. Waskita established a target to increase ERM’s ability to be 5 (leading) in the next few years.

Comparative Analysis between Realization and Target

Financial Performance

In general, the Company’s strategies and policies have been well implemented, even though the Covid-19 pandemic that started in Indonesia since early March 2020 has hit the infrastructure industry, including the Company. The Large-Scale Social Restriction (PSBB) policy has resulted in restrictions on public activities and real sector. Then, domestic economic activities, including the infrastructure, construction and property industries, were limited in motion, which in turn had affected overall performance of the Company. With this macroeconomic influence, the Company recorded a decrease in operating revenue of -48.42%, from Rp31.39 trillion in 2019 to a decrease of Rp15.20 trillion to Rp16.19 trillion in 2020.

Operational Performance

As one of the major players in the national construction service industry, the Company continues to develop its capacity in achieving its vision and mission. This effort is realized by the acquisition of work contracts that were successfully booked by the Company throughout 2020, through 3 (three) work contract business models.

The three work contract business models are:

- Self-Handled Construction Services Contract

- Joint Operations (JO)

The Company conducts joint operations with other parties as one of the strategies to obtain a project. Join operations is a form of cooperation with JO partners whose objective is to obtain optimal synergy related to technical and nontechnical competencies in order to acquire the project and its implementation, so that the Company gain value added in the form of profit, technology transfer, and experience. JO projects are recorded only for contracts and profits. Types of managed contracts are among others: - Lump Sum Contract

A lump sum contract is a procurement contract for the completion of all work offered in accordance with agreed terms including drawings, specifications, schedules, and others within a specified period with a determined and fixed amount of prices. All elements in the contract are agreed in writing before the work begins. the service user pays the price for the completion of work based on the predetermined payment method. - Unit Price Contract

Unit price contract is a procurement contract for the completion of all work within a certain time limit based on a determined and fixed unit price for each unit of work with certain specifications. - Design and build contract

Design and build contracts are project contracts where the planning and implementation work is assigned to a service provider (planner) appointed by the contractor, not by service users or to a collaborative agency between planners and contractors. - Investment

the Company has invested in concrete production/ manufacturing, construction and concessions of toll road, property, realty, hotels and non-toll road infrastructure through its subsidiaries, namely PT Waskita Beton Precast Tbk, PT Waskita Toll Road, PT Waskita Karya Realty, and PT Waskita karya Infrastruktur.

In 2020, the Company participated in the auction of 105 projects with a total value of Rp39.38 trillion and won 37 project auctions by recording new project value of Rp21.46 trillion. Therefore, the Company’s competitiveness in terms of project value is 54.59%. In the same year, the Company’s competitiveness increased by 3.92% from the previous year. The number of projects won by the Company also increased by 27.59% compared to the previous year. This shows that even in the conditions of the Covid-19 pandemic, the Company’s marketing performance managed to show an increase compared to the previous year.

Business Segment Performance

Construction segment

The Company continues to develop its capacity as one of the main players in the national construction service industry, through the business performance of 5 (five) Divisions, namely Building Division, Infrastructure I Division, Infrastructure II Division, EPC Division, and Overseas Division. Throughout 2020, the Company successfully carried out and completed several Construction Segment projects in accordance with the work contract agreement, including:

| No | Project Name | Owner | Contract Value (Rp-million) | Period | |

| Starts | Ends | ||||

| 1 | Soekarno-Hatta Airport Substation Project | PT Angkasa Pura II (Persero) | 221,166 | March 15, 2017 | February 8, 2020 |

| 2 | Revitalization of Ragunan Sports Center | Dinas Pemuda dan Olahraga | 374,963 | August 1, 2019 | February 8, 2020 |

| 3 | Bridge connecting 2B Island with Kosambi | PT Kukuh Mandiri Lestari | 459,000 | July 27, 2017 | February 28, 2020 |

| 4 | Roads and Hospital Areas on Galang Island | Kementerian PUPR | 49,450 | March 7, 2020 | March 28, 2020 |

| 5 | Terbanggi Besar – Pematang Panggang - Kayu Agung Toll | PT Hutama Karya (Persero) | 11,696,184 | June 16, 2017 | March 30, 2020 |

| 6 | Ogan Bridge, Kayu Agung – Palembang – Betung Toll Road | PT Waskita Sriwijaya Tol | 1,263,233 | May 31, 2016 | May 30, 2020 |

| 7 | Bakter Rest Area Package 2 | PT Hutama Karya (Persero) | 324,229 | July 8, 2019 | May 30, 2020 |

| 8 | Isolation Room of Fatmawati Hospital | RS Fatmawati Dep. Kesehatan | 27,580 | May 1, 2020 | May 31, 2020 |

| 9 | Kuala Tanjung Multi Purpose | PT Prima Multi Terminal | 1,054,690 | April 30, 2015 | June 18, 2020 |

| 10 | Covid-19 Isolation Room of RSUP H Adam Malik | Ditjen Pelayanan Kesehatan Kemenkes | 23,282 | May 18, 2020 | July 1, 2020 |

| 11 | Reconstruction of Papua Province KPU Building | Kementrian PUPR RI | 10,332 | September 13, 2019 | July 14, 2020 |

| 12 | Yukata Alam Sutera Apartment | KSO Waskita Triniti 2 | 242,436 | August 1, 2017 | July 31, 2020 |

| 13 | Galang Island Hospital | PUPR Cipta Karya | 166,722 | March 7, 2020 | August 28, 2020 |

| 14 | ROAD S 24 BLOK-K MM2100 CIKARANG | PT Bekasi Matra Industrial Estate | 95,892 | October 1, 2019 | September 25, 2020 |

| 15 | UNDERPASS MM2100 | PT Bekasi Fajar Industrial Estate | 119,560 | July 16, 2019 | December 15, 2020 |

Construction segment recorded Revenues of Rp24.70 trillion a decrease of 13.8% or Rp3.95 trillion when compared to 2019 amounting to Rp28.65 trillion. Gross Profit was recorded at Rp1.20 trillion a decrease of 74.82% or Rp3.65 trillion when compared to Rp4.75 trillion in 2019. The decline was caused by the Covid-19 pandemic.

Toll Segment

The Company carries out its business in the Toll Segment through its subsidiary engaged in toll road development, namely PT Waskita Toll Road (WTR) which own investments in several toll roads.

Throughout 2020, the Company successfully carried out and completed several Toll Segment projects in accordance with work contract agreement.

In 2020, Toll Segment booked Revenues of Rp390.60 billion, a decline of 20.09% or Rp.98.19 billion when compared to 2019 amounting to Rp488.80 billion. The decline was due to a corporate action in the form of divestment/release of Company’s shares in PT Kresna Kusuma Dyandra Marga (“KKDM”) through the Limited Participation Mutual Funds mechanism, hence the Company no longer consolidates KKDM toll road revenues.

Meanwhile, Gross Profit was recorded of Rp185.50 billion, decreased by 28.67% or Rp74.57 billion when compared to 2019 of Rp260.07 billion. Such decrease was due to a corporate action in the form of divestment/release of Company’s shares in PT Kresna Kusuma Dyandra Marga (“KKDM”) through the Limited Participation Mutual Funds mechanism, hence the Company no longer consolidates KKDM toll road revenues.

Precast Segment

The Company owns a precast concrete plant managed by its subsidiary, PT waskita Beton Precast Tbk (wSBP), which has listed its shares on the Indonesia Stock Exchange on September 20, 2016. Until the end of 2020, WSBP has 9 plants with a total capacity reached 3.7 million tonnes.

Throughout 2020, the Company successfully carried out and completed various Precast projects in accordance with work contract agreement.

Revenues from Precast Segment in 2020 amounted to Rp1,88 trillion, decreased by 3.22% or Rp62.37 billion compared to 2019 amounted to Rp1.94 trillion.

Meanwhile, Gross Profit was recorded at minus Rp3.98 trillion decreased by 940.65% or Rp4.46 trillion compared to 2019.

Property and Hotel Segment

In the property and hotel sector, the Company has managed several hotels such as Teraskita Hotel Jakarta, Teraskita Hotel Makassar, Maison Teraskita Hotel Bandung and The Reiz Suites Medan. As for the property sector, such as Vasaka The Reiz Condo Medan, Vasaka Nines, Vasaka Bali, Soltera and Avasta.

Throughout 2020, the Company successfully carried out and completed several Property and Hotel Segment projects in accordance with the work contract agreement, including:

| No | Project Name | Owner | Contract Value (Rp) | Period | |

| Starts | Ends | ||||

| 1 | Teraskita Hotel Jakarta | PT Waskita Karya Realty | 134 Billion | 2013 | 2015 |

| 2 | Teraskita Hotel Makassar | PT Waskita Karya Realty | 89 Million | 2018 | 2020 |

| 3 | Maison Teraskita Bandung | PT Waskita Karya Realty | 55 Million | 2018 | 2021 |

| 4 | Vasaka The Reiz Condo Medan | PT Waskita Karya Realty | 390 Billion | 2016 | 2018 |

| 5 | Vasaka Nines | PT Waskita Karya Realty | 622 Billion | 2018 | 2025 |

| 6 | Vasaka Bali | PT Waskita Karya Realty | 484 Billion | 2021 | 2023 |

| 7 | Solterra | PT WFPR | 549 Billion | 2018 | 2025 |

| 8 | Avasta | PT WMR | TBA | 2021 | 2023 |

Property and Hotel Segment posted revenues amounted to Rp477.41 billion, increased by 102.03% or Rp241.10 billion when compared to 2019 amounted to Rp236.31 billion. Meanwhile, Gross Profit decreased by 2.53% or Rp69.69 billion, down by Rp1.82 billion compared to 2019’s gross profit of Rp71.51 billion. The decrease was caused by the impact of the Covid-19, government regulations on PSBB and additional fixed costs to maintain health protocols for customers, suppliers and employees when at the hotel.

Other Infrastructure Segment

The Company developed and established a subsidiary, namely PT Waskita Karya Infrastruktur which became a Holding Company for PT Waskita Sangir Energi which is engaged in Minihydro Power Plant (PLTM) with an output capacity of 2x5 Megawatts. Up to date, the company has grown and made a positive contribution to the Company.

Throughout 2020, the Company successfully carried out and completing several Other Infrastructure Segment projects in the form of procuring steel fabrication and power transmission, in accordance with the work contract agreement, among others:

| No | Project Name | Contract Value (Rp) |

| 1 | Procurement of 500KV Sumatra Transmission Package 3 Muara Enim - New Aur Duri Zones 1-2 | 253,796 |

| 2 | Procurement of 500KV Sumatra Package 3 Transmission Muara Enim - New Aur Duri Zone 3 | 133,187 |

| 3 | Procurement of Guardrail Type A - Kuala Tanjung Toll Road Project - Inderapura Zone 2 | 9,821 |

Revenues from Other Infrastructure Segment in 2020 amounted to Rp177.04 billion, increased by 240.65% or equivalent to Rp125.07 billion when compared to 2019 amounted to Rp51.97 billion. Such increase was caused by the operational commencement of new business unit in the tower and guardrail manufacturing sector. Meanwhile, Gross Profit was recorded at Rp66.48 billion, an increase of 67.04% or Rp26.69 billion when compared to Rp39.80 billion in 2019. The increase was due to the increase in revenues due to the operational commencement of new business unit in the tower and guardrail manufacturing sectors.

Building Rental Segment

Building Rental segment is one of non-construction service business segments that has been developed by the Company and is a form of owned-asset optimization by providing additional services through building rental.

Until the end of 2020, the Company succeeded in managing and leasing buildings as many as 1 (one) building units. Building rental segment revenue amounted to Rp8.72 billion, experiencing an increase of 548.44% or Rp7.37 when compared to 2019 amounting to Rp1.34 billion. The increase was caused by the floors in the Waskita Rajawali Tower building have been filled by tenants such as PT Waskita Toll Road, PT Waskita Karya Realty, PT Waskita Karya Infrastruktur and other tenants.

Gross Profit was recorded at Rp4.53 billion, increase of 237.28% or Rp3.19 when compared to Rp1.34 billion in 2019. The increase was due to increase in operating income is due to the fact that the floors in the Waskita Rajawali Tower building have been filled by tenants such as PT Waskita Toll Road, PT Waskita Karya Realty, PT Waskita Karya Infrastruktur and other tenants.

... Read MoreShow Less

Constraints, Challenges, and Solutions

The Covid-19 pandemic greatly affected the Company’s business processes and had a significant impact on the declining Company’s financial performance. This was due to delays in construction and investment project tenders, delays in construction implementation, delays in receiving terminals due to reallocation of the government infrastructure budget, and a decrease in the Company’s investment performance, such as a decrease in toll operating income due to the implementation of strict health protocols, a decrease in recurring income from hotels and others.

The Covid-19 pandemic has also disrupted the Company’s strategy to divest toll roads due to low investor interest, limited domestic investor funds and lower selling prices. Thus, the Company must bear high financial costs due to the operation of its toll roads.

To achieve the predetermined vision, Waskita adjusted its Corporate strategy to be line with the priorities of the Ministry of SOEs, among others by making cost efficiency and optimizing CAPEX and being selective in acquiring new projects that are in line with the Ministry of SOEs related to specialization, accelerating payment of project terms and other bills postponed due to the Covid-19 pandemic, as well as carrying out business transformation through specialization and development of Waskita’s core competencies to become a market leader in the champion segment and increase the Company’s capabilities.

In addition, the Company also developed integrated systems and technology by implementing BIM & ERP, as well as divesting toll roads and other assets to increase funding capacity. The Company also expanded and competed in the international market, particularly in projects with the progress payment type and completed the construction of existing investment projects according to target, while maintaining the standardization of processes and applicable policies, and continuously developing human capital talents through the development of a Corporate Culture in line with the Company’s strategy, implementing the Exploring and Sharing program, implementing the Employee Retention program through Reward & Punishment, optimizing the Talent Management program and increasing the capacity and capability of millennial talents and female talent.

... Read MoreShow Less

Analysis on Business Prospect

The 2021 national economy outlook is predicted to improve in line with the projection for global economic recovery and the impact of fiscal support on accelerating economic recovery, including support for pandemic control. Entering 2021, the Government through the Ministry of Finance has released the Draft of 2021 State Revenue and Expenditure Budget (RAPBN) “Accelerating Economic Recovery and Strengthening Reforms” on August 14, 2020. In the 2021 State Budget Draft, national economic growth is targeted to grow at 4.5 % to 5.5% with an inflation rate of 3.0%. Meanwhile, to contain the negative impact of the Covid-19 pandemic on the economy, the Government has also taken and will continue to take extraordinary policy steps to maintain and restore the health and socio-economic conditions of the community and the business world.

State spending in the 2021 State Budget Draft is projected to reach Rp2,747.5 trillion or 15.6% of Gross Domestic Product (GDP), which is directed at supporting economic recovery and development priorities in the fields of health, education, information and communication technology, infrastructure, food security, tourism, and social protection. Meanwhile, the Government has allocated a budget for infrastructure development in 2021 amounting to Rp417 trillion. The infrastructure development policy in 2021 is post-Covid-19 pandemic sustainable development by strengthening digital infrastructure and encouraging logistical efficiency and connectivity.

Infrastructure policies are directed at labor-intensive infrastructure that supports industrial and tourism areas, development of public health facilities and basic necessities such as water, sanitation and housing to support the strengthening of national health system. The 2021 infrastructure budget is also earmarked for the completion of pending prioritized activities in 2020.

The 2021 strategic output target for basic services is the construction of 10,706 flats and special houses, 53 units of dams, in which 43 units are being built and 10 units are new. Furthermore, access to sanitation and solid waste to serve 1,643,844 heads of households (KK), irrigation network along 600 km, which is rehabilitated along 3,900 km, and land irrigation network along 100 km. Meanwhile, for connectivity, 965.4 km of roads, 26.9 km of bridges, 446.56 km of railway lines (km’sp) and airport of 10 units/location will be built. To increase economic competitiveness, the Government will continue to complete infrastructure development targets in various regions in the form of new national roads, dams, irrigation networks and toll roads to connect major islands such as Java, Sumatra, Kalimantan, Sulawesi and Papua.

Meanwhile, in the energy and electricity sector, the construction of natural gas networks for households totaling 120,776 household connections (SR), Rooftop Solar Power Plant (PLTS) & PLTS Cold Storage amounting to 11.8 MegaWatt-peak (MWp). For Information Technology (IT), Base Transceiver Stations (BTS) will be built in 5053 locations in disadvantaged, frontier and outermost areas (3T) and Palapa Ring in western Indonesia of 40%, middle Indonesia of 30%, and eastern Indonesia of 30%.

The budget for infrastructure development in 2021 allocated by the Government in the amount of Rp.417 trillion, is an opportunity for the Company. With its strengths, the Company is optimistic to be able to optimize these opportunities and improve the Company’s performance. The Company’s success in 2020 has become a valuable capital for the Company to improve its performance in 2021. The management considers that the Company’s business outlook in 2021 are still bright, even though still overshadowed by uncertain macroeconomic conditions, due to the impact of the Covid-19 pandemic which is estimated to be still continues in 2021.

... Read MoreShow Less

2021 Projections

The 2021 Company’s projections are contained in the Corporate Work Plan and Budget (RKAP) for 2021 prepared by Board of Directors, then approved by Board of Commissioners, to be subsequently approved by the Shareholders and reported to the Financial Services Authority. The RKAP is the principal reference for the Company in carrying out its business activities.

The main operational and financial performance projections for 2021 are based on various economic assumptions that may affect the Company’s activities. One of the influencing factors is the unstable global economic conditions until the end of 2020, due to the Covid-19 virus pandemic that has hit almost all countries including Indonesia, which resulted in a decline in global economic activities throughout 2020. However, the national economic recovery program as one of the series of activities to reduce the impact of Covid-19 on the economy initiated by the Government in mid-2020, has brought a little breath of fresh air for business players.

In 2021, the Company projects to participate in the auction activities of as many as 224 projects with a total value of Rp85.300 trillion and the target of winning 57 projects with a total value of Rp21.05 trillion. The projected total value of new contracts in 2021 including those of subsidiaries is Rp25.90 trillion. There is a decline in the value of new contracts between realization in 2020 and projection in 2021, because the Company realistically calculates that the Covid-19 pandemic will continue in 2021, hence causing cuts in infrastructure budget and delays in project tenders. In addition, the Company also chooses to be more selective in participating in investment projects and turnkey projects, in order done to maintain overall performance of the Company.

Marketing Projection for 2021

The marketing projection for 2021 is based on the construction services market in Indonesia which is not only influenced by the development of the Government’s strategic programs, but is also closely related to the development of Indonesia’s macro economy and other global issues, especially the impact of Covid-19 on the pace of national development.

In 2020, the Company’s acquisition of New Contract Value will be based on the business development segment. Therefore for 2021, the Company will endeavor very intensively to rely on projects from the Government, with a portion reaching 42.66%. In addition to focusing on the Government segment, the Company also continues to rely on the domestic private segment with a portion of 21.81% and overseas projects with a portion of 8.30%, business development segment with a portion of 18.73%, and SOE/RPE segment with a portion of 8.48%.

The Company hopes that the private sector will immediately rise up to continue their projects, one of which is with the ease of regulation and the existence of tax relaxation policy from the Government, so that business players can create market for the purpose of economic recovery and economic & health resilience (due to the impact of Covid-19) involving private parties.

Human Capital Management Projections

In 2021, the Company projects the number of employees to be 1,990 employees, an increase of 1.6% from the realization in 2020. The projected number of employees in 2021 is expected to be in line with the total value of new contracts to be obtained by the Company.

As for the cost of training and education in 2021 is projected to be Rp11 billion, an increase of 138.8% compared to the realization in 2020 of Rp4.61 billion. Even though 2021 will still be faced with the Covid-19 pandemic, however, the Company has carried out infrastructure development to support digital-based training and development activities which are expected to make it easier to realize these programs.

... Read MoreShow Less

Assessment of Performance of Committees under Board of Director

Until the end of 2020, Board of Directors does not have a Committee under the Board. Thus there is no information can be presented regarding the assessment of performance of committees under Board of Directors.

Development of Corporate Governance Implementation

The Company strives to enhance and improve the implementation of GCG principles, not only in line with regulatory demands, but also in accordance with international best practices/standards. For the Company, the implementation of GCG is a must, in order to achieve the best performance in a sustainable manner.

We can convey that the Company always implements a high standard of Good Corporate Governance (GCG) practice which refers to the Decree of Minister of SOE SK-16/S.MBU/2012 dated June 6, 2012 concerning Indicators/Parameters for Assessment and Evaluation of Good Corporate Governance Implementation in State-Owned Enterprises, General Guidelines for Indonesian GCG issued by the National Corporate Governance Committee (KNKG), and international standards according to the ASEAN CG Scorecard framework which is in line with the parameters set by the Organization for Economic Cooperation and Development (OECD) ). Several key issues related to GCG implementation are as follows:

GCG Structure and Mechanism

The Company has a strong and effective GCG structure consisting of the main organs, namely the General Meeting of Shareholders (GMS), the Board of Commissioners and the Board of Directors. The three organs of the Company have carried out their respective roles in fulfilling their obligations to shareholders and other stakeholders.

GMS is the Corporate organ that holds the highest power as well as holds all authority that cannot be delegated or assigned to Board of Commissioners and Board of Directors. The GMS as an organ of the Company is a forum for shareholders to make important decisions related to the capital invested in the Company, by taking into account the Articles of Association and the Limited Liability Company Law. In addition, GMS also functions as a forum for accountability of Board of Commissioners and Board of Directors for their performance results in a predetermined period of time.

During 2020, the Company held an annual GMS as mandated by the Shareholders and the Articles of Associations. Board of Commissioners and Board of Directors, have clear powers and responsibilities according to their respective functions as mandated in the Articles of Association and laws and regulations.

In more detail, the guidelines and work rules of Board of Directors are arranged in the Board Manual which regulates the Working Guidelines for Board of Commissioners and Board of Directors, among others, contains work instructions for Board of Directors in a structured, systematic, easy to understand and can be executed consistenly, and can be a reference for Board of Directors in carrying out their respective duties to achieve the Company’s vision and mission. With the Board Manual, it is hoped that high working standard will be achieved, in line with the principles of GCG.

Risk management

The Company’s Risk Management Guidelines which refer to ISO 31000: 2018 standard also describe the relationship between risk management principles, risk management frameworks and risk management processes in an effort to control risk in order to achieve the Company’s vision, mission and objectives/goals.

Optimizing the effectiveness and efficiency of risk management requires strong commitments from all elements of the Company, including from internal and external environments. All elements of the Company have a role in managing risks according to their respective portions, starting from the process of identification, determination of strategy, dissemination, to evaluation of effectiveness. To that end, the Company has established a Risk Management Policy which serves as a principle held firmly in every procedure and mechanism of risk management. These policies include:

- Complying with applicable laws and other requirements based on the Principles of Good Corporate Governance, namely Transparency, Accountability, Responsibility, Independency, and Fairness as a step in implementing Risk Policy.

- Understanding that risk exists in all forms of business processes and decision making to achieve the Company’s business goals.

- Managing all the Company’s risks optimally by utilizing the Company’s resources so that they remain within the limits of the Company’s Risk Tolerance.

- Improving a sustainable risk management system by adjusting the current conditions and maintaining a risk awareness culture in order to maintain Corporate value and Stakeholder trust.

Internal Control System

One of the implementations of Good Corporate Governance is to ensure that the Internal Control System (SPI) runs effectively. Given that an effective Internal Control System is able to give stakeholders confidence that all resources owned by the Company are well managed in the pursuit of achieving its goals.

The implementation of Internal Control System is directed at ensuring that the Company has reliable financial reports and information, comply with applicable regulations, as well as efficiency and effectiveness of operational activities.

For this reason, the Company continues to apply an effective internal control system by involving Board of Commissioners, Board of Directors, and all Waskita people by referring to the principles of Internal Control-Integrated Framework issued by The Committee of Sponsoring Organization (COSO) of the Treadway Commission.

Code of Conduct

Waskita strives to carry out a business in accordance with GCG principles. To realize it, Waskita already has the Code of Conduct. The Code of Conduct represents a set of guidelines containing the principles governing how Waskita People carry out daily values of the Company. Waskita’s Code of Conduct is built on a strong foundation of corporate vision and values that are upheld in all functions and in all areas of Waskita’s business network.

Waskita Code of Conduct must be obeyed and implemented by all Waskita People, which is marked by the signing of Integrity Pact by all Waskita People as a concrete manifestation of their commitment to implementing the Company’s Code of Conduct.

In order to increase the effectiveness of GCG implementation, the Company’s management is committed to running the Company in a professional manner based on corporate behavior in accordance with the Code of Business Conduct and Corporate Values, in order to realize good corporate governance. Therefore, the Company has also built a Whistleblowing System (WBS).

Whistleblowing System

The Whistleblowing System (WBS) was introduced to strengthen the implementation of Good Corporate Governance (GCG) and in order to provide opportunities for all Company personnel and other Stakeholders to be able to submit reports regarding indications of violations of applicable ethical values, based on accountable evidence and with good intentions.

Corporate Social Responsibility

Corporate Social Responsibility (CSR) is one of the main GCG implementations in the Company. The Company is fully aware that the fulfillment of the rights of stakeholders including customers, employees, society and the environment, and the state is a key factor in achieving sustainable performance.

The Company places CSR as part of its long-term program. In an effort to achieve a sustainable business, the Company strives to provide optimal performance for shareholders but also thinks about how to contribute optimally in social and environmental aspects.

The basic principle of social responsibility programs implementation in the Company is based on several approaches, one of which is through the Partnership and Community Development Program (PKBL) or the Small Medium Enterprise Partnership Program & Social Responsibility (SMEPP & SR) which is guided by the Regulation of Minister of State-Owned Enterprises of the Republic Indonesia No. PER-02/MBU/7/2017 concerning the Second Amendment to the Regulation of the Minister of SOEs No. PER-09/MBU/07/2015 on the Partnership and Community Development Program for State-Owned Enterprises. This policy is an embodiment of the Limited Liability Company Law No. 24 of 2007 which requires limited liability companies to implement CSR programs.

In addition, in its application, the Company also carries out CSR programs based on the mandate that has been stated in the legal aspect, including:

- Circular Letter of the Ministry of State-Owned Enterprises No. SE-07/MBU/2008 dated May 5, 2008 concerning the Implementation of PKBL and Application of Article 74 of Law No. 40 of 2007 concerning Limited Liability Companies and the latest amendment No. PER-07/MBU/7/2017 dated July 5, 2017 concerning the SOE’s Partnership and Community Development Program.

- Circular Letter of the Ministry of State-Owned Enterprises No. SE-14/MBU/2008 dated June 30, 2008 concerning the Optimization of Partnership Program Funds through Distribution Cooperation.

- Article 74 of Law no. 40 of 2007 concerning Limited Liability Companies.

- Letter from the Ministry of SOE No. S-92/D5/MBU/2013 concerning the Management of Partnership and Community Development Programs.

Meanwhile, the financing and budget of social responsibility are inherent in every relevant operational activity of the Company, such as employee expenses, occupational health and safety, general expenses, customer service expenses and others. In addition, the Company also distributes funds for social responsibility activities in the form of Partnership and Community Development Program (PKBL) or SME & SRPP. The source of funds for PKBL or SME & SRPP activities is regulated by a policy, i.e. coming from the allocation of Company’s profit and expenses with a maximum allocation provision of 4% of the income after tax of previous fiscal year.

The realization of the Partnership Program funds in 2020 amounted to Rp1.60 billion, decreased compared to 2019 of Rp5.99 billion. The realization of the Community Development Program in 2020 was Rp8.77 billion, a decrease compared to 2019 of Rp33.33 billion. This was caused by several matter, i.e. the Corona-19 Virus pandemic which resulted in Fostered Partners having difficulty in making installments because their business was directly affected by this outbreak, and the Company’s liquidity condition was not good enough to provide Environmental Development Program assistance in accordance with the work plan target of SMEPP & SR.

... Read MoreShow Less

Changes in Board of Directors Composition

Throughout 2020, the Company’s Board of Directors has changed its structure and composition 1 (one) time, namely from January 1 to June 8, 2020 and June 8 to December 31, 2020.

The composition and structure of Board of Directors as of June 8, 2020 is as follows:

| Name | Position | Basis of First Appointment | Basis of Reappointment | Tenure |

| I Gusti Ngurah Putra | President Director | Deed No. 42 dated April 12, 2018 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Haris Gunawan | Director of Finance | Deed No. 42 dated April 12, 2018 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Hadjar Seti Adji | Director of Human Capital Management & System Development | Deed No. 42 dated April 12, 2018 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Fery Hendriyanto | Director of Business Development & Quality, Safety, Health & Environment | Deed No. 42 dated April 12, 2018 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Didit Oemar Prihadi | Director of Operation I | Deed No. 42 dated April 12, 2018 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Bambang Rianto | Director of Operation II | Deed No. 127 dated March 31, 2017 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Gunadi | Director of Operation III | Deed No. 44 dated May 15, 2019 | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

Based on the Resolution of the Annual GMS of the 2019 Fiscal Year held on June 5, 2020, the composition of Board of Directors experienced changes, so that the composition of Board of Directors until December 31, 2020 is as follows:

| Name | Position | Basis of First Appointment | Basis of Reappointment | Tenure |

| Destiawan Soewardjono | President Director | Deed No. 08 dated June 8, 2020 (Appointment through the GMS on June 5, 2020) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Taufik Hendra Kusuma | Director of Finance | Deed No. 08 dated June 8, 2020 (Appointment through the GMS on June 5, 2020) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Hadjar Seti Adji | Director of Human Capital Management & System Development | Deed No. 42 dated April 12, 2018 (Appointment through the GMS on April 6, 2018) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Fery Hendriyanto | Director of Business Development & Quality, Safety, Health & Environment | Deed No. 42 dated April 12, 2018 (Appointment through the GMS on April 6, 2018) | - | Until the 5th Annual General Meeting of Shareholders after thefirst appointment |

| Didit Oemar Prihadi | Director of Operation I | Deed No. 42 dated April 12, 2018 (Appointment through the GMS on April 6, 2018) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Bambang Rianto | Director of Operation II | Deed No. 127 dated March 31, 2017 (Appointment through the GMS on March 17, 2017) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

| Gunadi | Director of Operation III | Deed No. 44 dated May 15, 2019 (Appointment through the GMS on May 9, 2019) | - | Until the 5th Annual General Meeting of Shareholders after the first appointment |

Changes in the composition and strucure of Board of Directors are fully rights and authorities of the Shareholders, which are subsequently appointed by the Resolution of General Meeting of Shareholders.

... Read MoreShow Less

Appreciation

Finally, please allow us as Board of Directors to express our deepest gratitude and appreciation to Board of Commissioners for all the directives and advice given to Board of Directors. We also convey the same appreciation to all shareholders and business partners for their support, trust and good cooperation so far. To all Waskita People, Board of Directors would like to express their gratitude and highest appreciation for the work, commitment, dedication and love in carrying out respective duties and responsibilities as well as supporting the efforts to realize the Corporate Vision, Mission and targets in 2020.

To all other stakeholders that we cannot mention one by one, we would like to express our gratitude for establishing the best cooperation, hence we can still carry out business activities amidst such tough challenges. Looking to the future, we are optimistic that we can continue to face coming days with better performance. May Allah, Almighty God, always bestows His blessings and conveniences for every step of our work and we should continue to make every efforts to achieve our joint wishes.

... Read MoreShow Less

Jakarta, March 25, 2021

President Director

PT Waskita Karya (Persero) Tbk

Destiawan Soewardjono